⚡ Someone just tokenized jet engines

Enterprise Onchain TLDR

The TLDR 👇

Wall Street’s Biggest Names Bet $11 Trillion on Ethereum

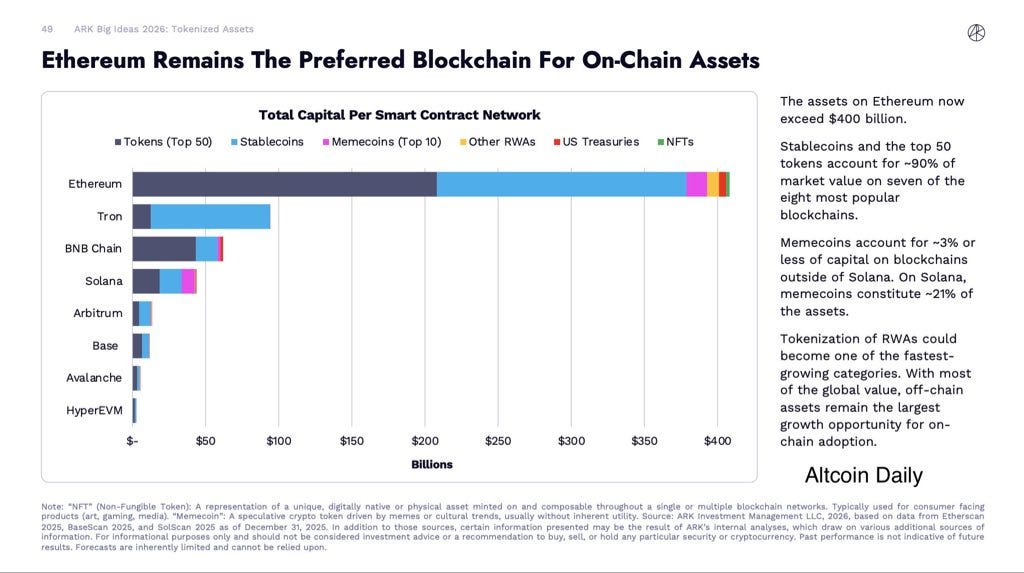

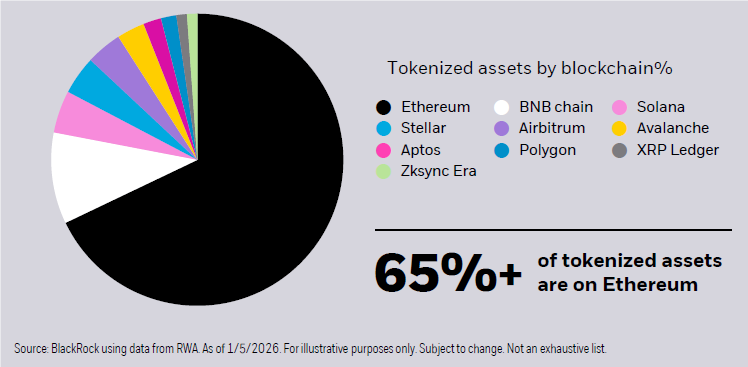

BlackRock and ARK Invest published their 2026 outlooks this week. The message was identical: tokenization is inevitable, and Ethereum is winning.

ARK projects the tokenized RWA market will hit $11 trillion by 2030, up from $19 billion today. That’s 580x growth in five years. BlackRock’s thematic report ( its 2026 thematic outlook) put a finer point on it: Ethereum underpins 65% of all tokenized assets across blockchains and “could be poised to benefit” as legacy institutions pile in.

The report frames what BlackRock calls “the convergence” of traditional markets becoming increasingly interconnected with crypto. Source.

BlackRock isn’t just talking. Its tokenized money market fund BUIDL now holds $1.6 billion, primarily on Ethereum. CEO Larry Fink went further this week, stating tokenization is “necessary” and will ultimately live on a common blockchain.

When the world’s largest asset manager and one of the most influential research shops agree this loudly, the signal is clear: the rails are being laid.

Capital One Acquires Brex for $5.15 Billion, Stablecoin Payments Included

Capital One struck a $5.15 billion deal to acquire fintech Brex, including its stablecoin payments solution. One of the largest fintech acquisitions in years, expected to close mid-2026.

Brex became the first global corporate card provider to offer native USDC payments in October 2025. Now that capability sits inside a top-10 U.S. bank.

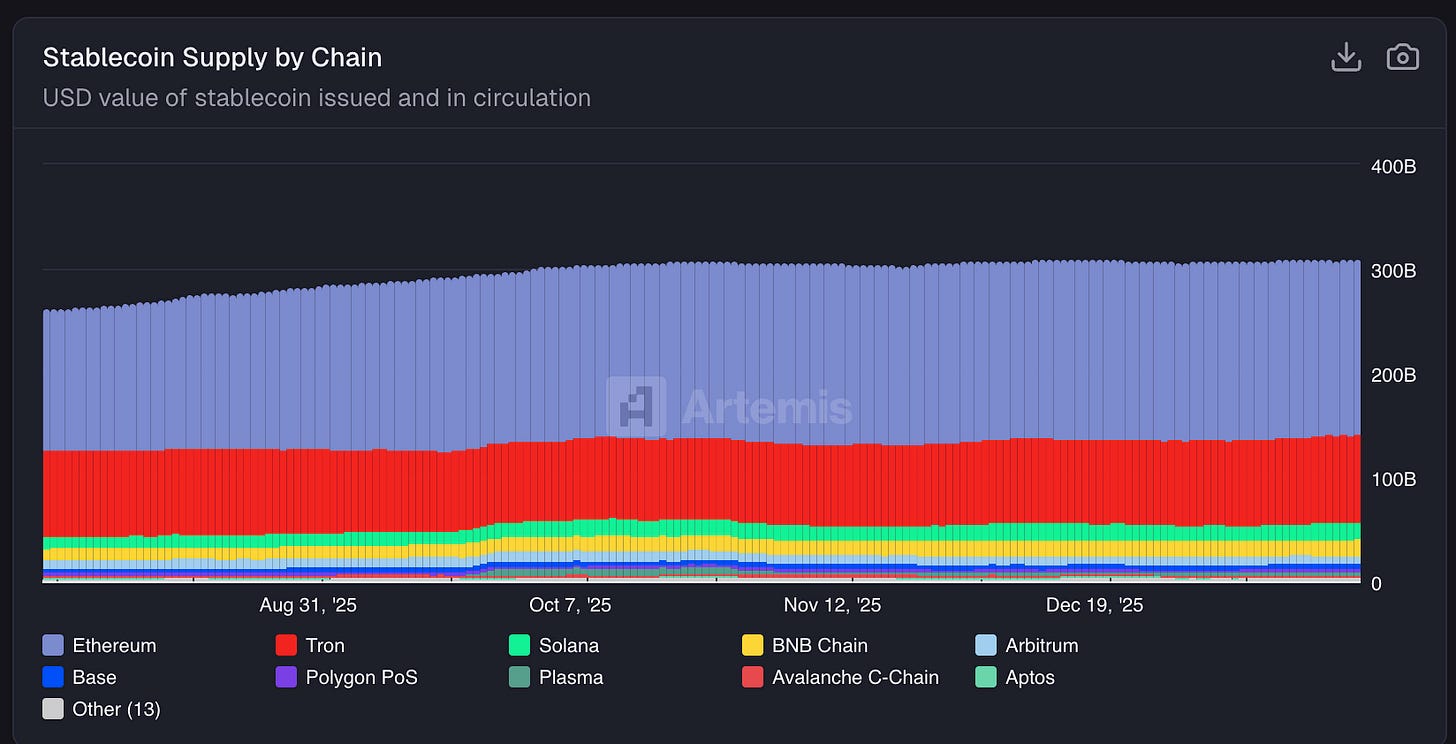

The timing isn’t accidental. Stablecoin market cap has grown 18.6% to a record $314 billion since the GENIUS Act passed in July. Capital One just paid $5 billion to avoid getting left behind. Source.

Ethereum Foundation Goes All-In on Post-Quantum Security

The Ethereum Foundation declared post-quantum security a top strategic priority, forming a dedicated team led by Thomas Coratger.

The EF has been researching quantum resistance since 2019. Now they’re moving to implementation: $2 million in prize initiatives (including a $1M Poseidon Prize), multi-client PQ devnets live across Lighthouse and Grandine, bi-weekly ACD calls starting next month, and workshops in Cannes (March) and October.

The roadmap targets a full transition to quantum-resistant cryptography “in coming years” with zero loss of funds and zero downtime. Source.

Ondo Tokenizes BitGo Stock Hours After NYSE Debut

BitGo went public on the NYSE on Wednesday at $18/share - 2026’s first major crypto IPO. Shares surged 36% intraday to $24.50 before settling back to close at $18.49. The custody firm raised $212.8M at a $2.08B valuation, above the marketed range.

But the bigger move came from Ondo Finance who launched tokenized BitGo shares on Ethereum on the same day - one of the first instances of tokenizing a US stock so quickly after its IPO. Non-US investors can now buy exposure using stablecoins without waiting for brokerage access.

This is tokenization’s value prop in action: collapsing global distribution from weeks to hours. Source.

Ten European Banks Launch Euro Stablecoin Consortium

A consortium of ten European banks, including BNP Paribas, ING, UniCredit, and Danske Bank, has formed Qivalis to launch a euro-pegged stablecoin. Target: H2 2026.

Leadership is notable: Jan-Oliver Sell (ex-Coinbase Germany CEO) as CEO, Howard Davies (ex-NatWest chair) as chair. The initiative is explicitly designed to counter U.S. dollar dominance in digital payments.

The euro stablecoin market has lagged far behind USD. Ten banks with combined trillions in assets just decided to change that.

OCC Rejects Warren's Call to Delay World Liberty Financial Bank Charter Over Trump Ties

Comptroller Jonathan Gould rejected Senator Elizabeth Warren’s request to pause review of World Liberty Financial’s national trust bank charter.

Warren argued the review should halt until President Trump divests from the crypto firm, citing “unprecedented conflicts of interest.” Gould, a Trump appointee, responded that the agency “intends to act consistent with its legal duty rather than your demand.”

Warren called the OCC’s review “a sham.” The charter application proceeds. Source.

Ethereum Treasury Firm ETHZilla Tokenizes $12.2M in Jet Engines

ETHZilla, a Nasdaq-listed Ethereum treasury company, acquired two CFM56-7B24 aircraft engines for $12.2 million through its new subsidiary.

The engines are leased to a major airline, making them yield-producing assets from day one. ETHZilla plans to tokenize them on Ethereum via its Liquidity.io partnership, targeting Q1 2026 for its first RWA token listing.

Jet engines aren’t sexy. But that’s the point: tokenization is moving beyond crypto-native assets into the industrial economy. Source.

Hungary and Portugal Block Polymarket Access

The regulatory noose around prediction markets keeps tightening.

Hungary temporarily blocked Polymarket’s domain, citing “forbidden gambling.” Portugal ordered the platform to wind down after flagging €4 million in wagers on the presidential race placed hours before results. Insider trading concerns.

Sound familiar? A Polymarket user netted ~$400,000 betting on Maduro’s removal just hours before U.S. forces captured him.

Polymarket is now blocked or restricted in France, Belgium, Poland, Singapore, Switzerland, Ukraine, Hungary, and Portugal, plus 33 countries it geoblocks itself. The core tension remains unresolved: regulators see gambling, the industry sees financial markets. Source.

What We are Watching

The EF’s institutional privacy team shipped a proof-of-concept for privacy-preserving bonds: ZK proofs plus UTXO notes that hide balances while giving regulators audit access. Keep an eye on their progress.

Insight of the Week

📊 $314 billion: Stablecoin market cap since the GENIUS Act passed, up 18.6%. Capital One just paid $5.15B to buy in.

Podcast of the Week

🎙️ Kevin O’Leary on Bitcoin and Ethereum Dominance

“When you do the data, it’s quite depressing. You get 97.2% of all the alpha in the entire crypto market with simply two positions: BTC and ETH. That’s it. You don’t need anything else.” Link.

5 Enterprise Job Opportunities in Crypto

→ Director of Product, Digital Assets & Stablecoin - Western Union (New York)

→ Principal Product Manager, Digital Assets - Circle (New Jersey)

→ Digital Assets & Tokenization Index Product Management - Nasdaq (New York)

→ VP - Digital Assets Product Strategy & Commercialisation - Bank of NY (London)

→ Global Head of Middle Office - Kraken (Remote)

Contact Us

We are starting a podcast - have a view you would like to talk about? Or want to sponsor? Reach out to us at our contact form here.

Thanks for reading - until next week!

Until next week,